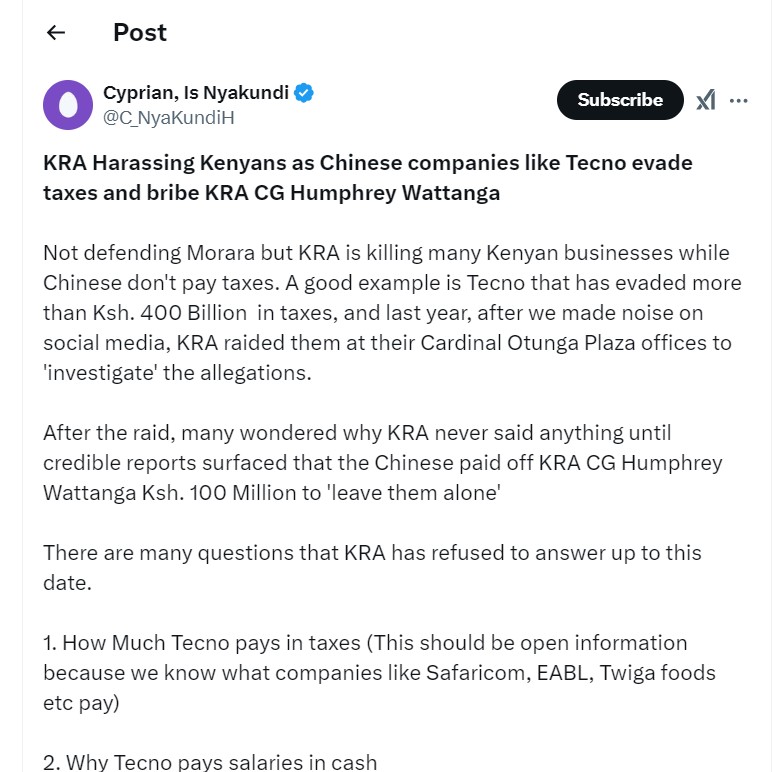

The Kenya Revenue Authority (KRA) is coming under increasing fire as it faces growing scrutiny over its handling of tax evasion allegations involving Chinese companies operating in Kenya, particularly Tecno.

According to blogger Cyprian Nyakundi on X, Despite claims that Tecno has evaded over KSh 400 billion in taxes, KRA’s response has been anything but transparent, leading many to wonder whether foreign businesses are being given preferential treatment.

KRA headquarters in Nairobi. Photo: Citizen TV Kenya Source: Facebook

In 2023, following intense public outcry, KRA conducted a raid on Tecno’s offices at Cardinal Otunga Plaza in Nairobi to investigate allegations of tax avoidance.

However, after the raid, the tax authority went silent, leaving the public in the dark.

As months passed, reports began to surface suggesting that Tecno had secretly paid KRA Commissioner General Humphrey Wattanga KSh 100 million to ensure the company would not face further scrutiny.

This has raised serious concerns about whether the tax body is turning a blind eye to certain companies while local businesses bear the brunt of enforcement.

As this story unfolds, ordinary Kenyans are becoming increasingly frustrated, demanding transparency about how much Tecno is actually paying in taxes.

Unlike local giants like Safaricom, EABL, and Twiga Foods, which openly report their tax contributions, Tecno has kept its figures under wraps.

Critics have also pointed to the company’s massive marketing budget of over KSh 3 billion annually and questioned why, despite its huge expenditure, Tecno pays significantly less in taxes than other businesses.

KRA commisioner general Humphrey Wattanga speaks during a past media. Photo: The Star Source: Facebook

There are also unsettling reports that KRA officials have been visiting Tecno’s offices on a regular basis, allegedly collecting private payments something that only adds fuel to the fire of suspicion.

The situation with Tecno isn’t an isolated case. Other Chinese companies, such as Opera and Okash, have also been accused of using proxy businesses to dodge taxes.

With more revelations emerging, the pressure is mounting for KRA to come clean about how much Tecno and others like it are actually contributing to Kenya’s tax revenues.

As the public’s frustration grows, questions about fairness, accountability, and the integrity of Kenya’s tax system are becoming more urgent. KRA must address these concerns head-on and provide clear, honest answers to restore trust with the people it serves. The consequences of continued silence and perceived double standards could be dire, undermining KRA’s credibility and eroding confidence in the country’s tax system.