Kenya Commercial Bank (KCB) faces public outrage following allegations that it has been sharing customer account details with third-party agents without consent.

The accusations claim that these agents, including digital lending apps, can access and directly deduct money from customers’ accounts, raising serious concerns about privacy and data security.

Reports indicate that customers who borrow from external lenders find their loan repayments automatically deducted from their KCB accounts without prior authorisation.

Bank statements allegedly show that the deductions are initiated by the lending agents, not KCB, suggesting the bank may have given third parties unrestricted access to customer accounts.

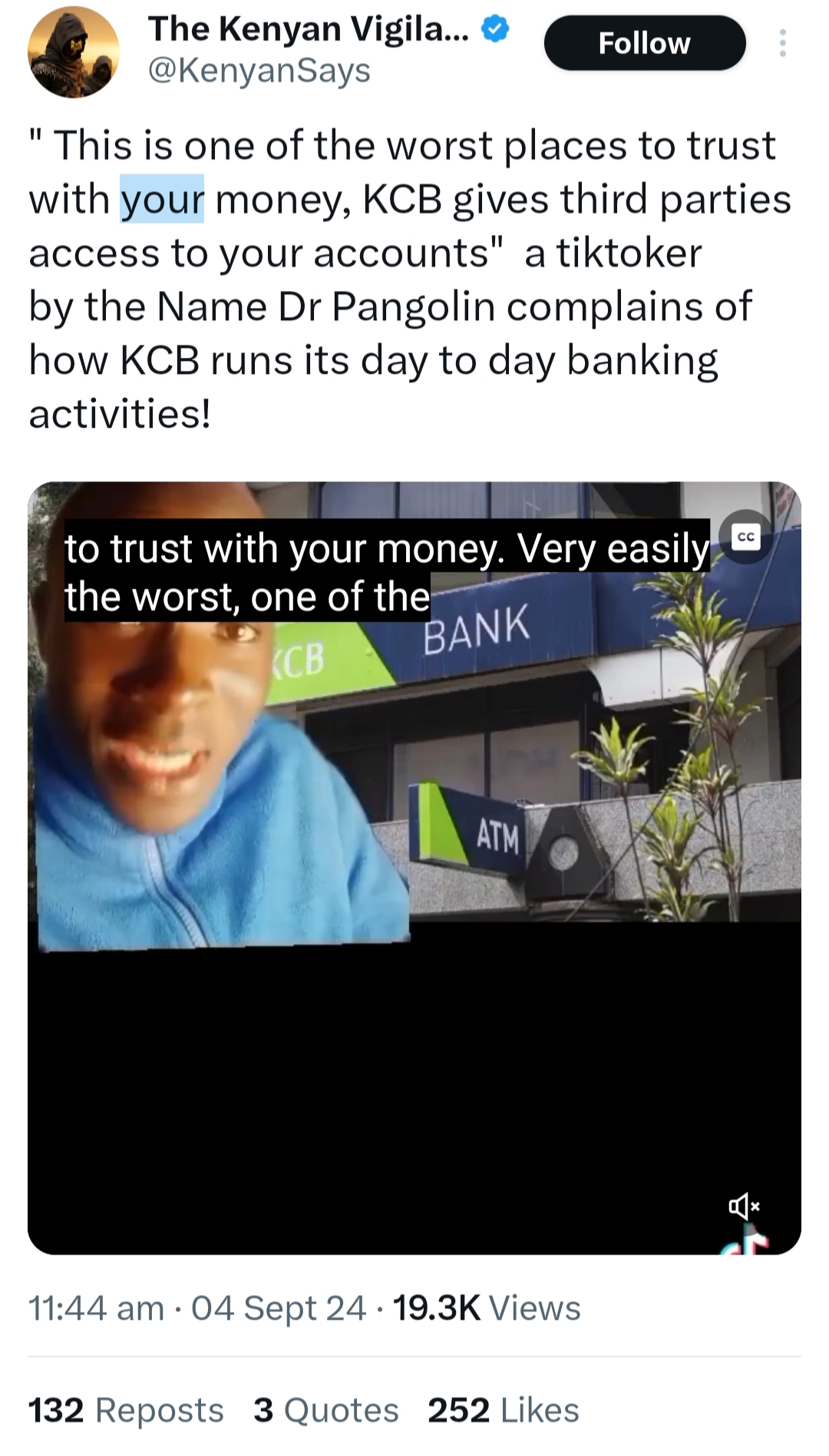

KCB bank. Photo: The Star Source: Facebook

Critics argue this practice likely violates Kenya’s Data Protection Act, which strictly forbids the unauthorised sharing of personal and financial information.

The controversy was brought to light by a TikTok user named Dr. Pangolin, whose video exposing KCB’s alleged practices went viral. “This is one of the worst places to trust with your money,” he claimed, accusing the bank of compromising customer trust. The video has sparked widespread debate and calls for a thorough investigation into KCB’s operations to determine if the bank is in breach of data protection laws.

So far, KCB has remained silent on the accusations. The bank’s lack of response has fuelled further speculation, with many Kenyans questioning the safety of their financial information.

“This is one of the worst places in Eastern and Central Africa to trust with your money. This is the bank where you can have money in your bank account and wake up and find out that literally you have nothing.

“KCB bank literary gives third parties access to your accounts. If you have any loan anywhere, your money is deducted to settle that loan…,” Mr Pangolin said.

The incident has reignited discussions about the need for stricter enforcement of data privacy laws and greater accountability from financial institutions in safeguarding customer information.

As public pressure mounts, all eyes are on KCB to clarify its stance on the matter and reassure its customers of their data’s security.