Former Kiambu Governor William Kabogo has sparked a fresh debate on Equity Bank’s past scandals, accusing the Central Bank of Kenya (CBK) of failing to take action.

Kabogo’s comments were made on X, formerly Twitter on August 16 where he was responding to to a post by blogger Cyprian Nyakundi.

Dr. James Mwangi, the Chief Executive Officer Equity Bank

Nyakundi had earlier posted about the recent Ksh 1.5 billion fraud at Equity Bank, where an insider allegedly colluded with criminals to steal the money.

In his post, Nyakundi criticised the bank’s history of insider fraud and the seeming lack of accountability. He questioned why the CBK and other regulatory bodies have not intervened, despite numerous reports of malpractice.

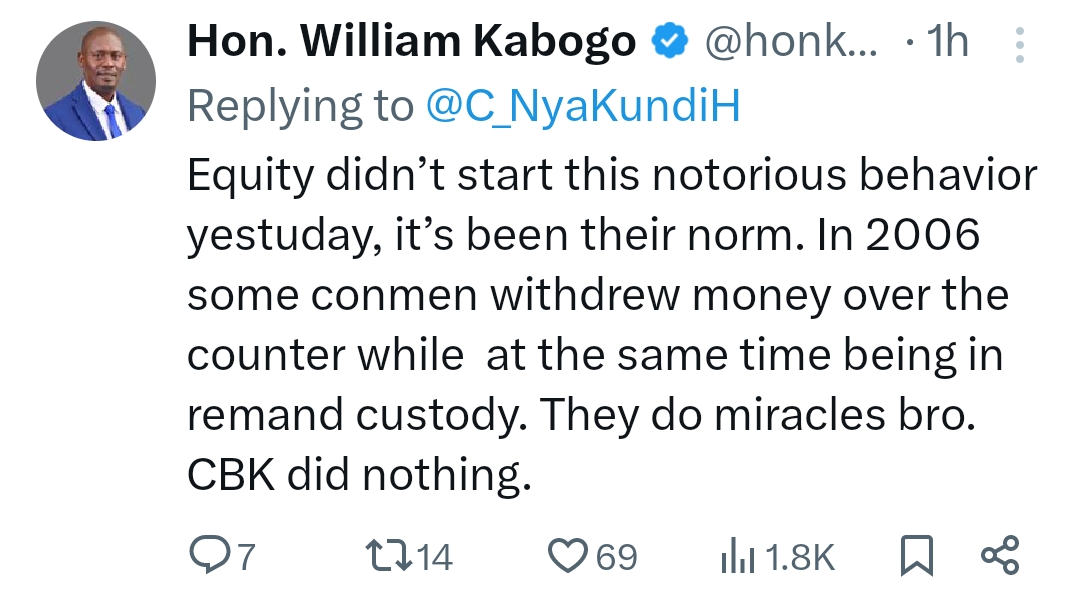

Kabogo echoed these concerns in his own post, recalling an incident from 2006.

He wrote, “Equity didn’t start this notorious behaviour yesterday; it’s been their norm. In 2006, some conmen withdrew money over the counter while at the same time being in remand custody. They do miracles, bro. CBK did nothing.”

Former Kiambu Governor Hon. William Kabogo

Also, Kabogo’s remarks suggest that Equity Bank has a long history of questionable activities, and that the CBK has consistently turned a blind eye.

On the other hand, Nyakundi’s original post also pointed out that Equity Bank has faced numerous customer complaints about lost money, with no significant action taken. He alleged that the bank’s CEO, James Mwangi, has used political influence to protect the bank, regardless of the political climate.

The Ksh 1.5 billion heist is just the latest in a series of scandals that have raised concerns about Equity Bank’s practices. As investigations continue, the public is left questioning the integrity of the bank and the role of the CBK in regulating the industry. So far, the CBK has not issued a response.