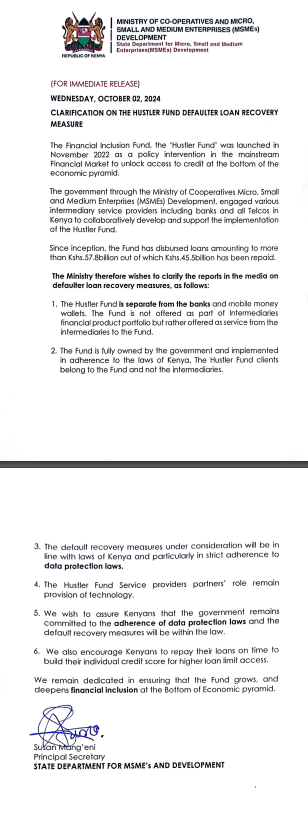

The Ministry of Co-operatives and Micro, Small, and Medium Enterprises (MSME) Development has moved to clarify the loan recovery measures for the Hustler Fund following a wave of public concern.

In a statement issued on Wednesday, October 2, 2024, the Ministry emphasized that the Hustler Fund is not linked to banks or mobile money wallets and has no intention of using them to recover defaulted loans.

Cooperatives CS Wycliff Oparanya during a past media presser. Photo: Citizen Digital Source: X

Principal Secretary Susan Mang’eni, speaking on behalf of the Ministry, dismissed claims suggesting otherwise.

“The Hustler Fund is separate from the banks and other money wallets,” she said.

“The Fund clients belong to the Hustler Fund, not the intermediaries.”

The Ministry made it clear that the role of intermediaries, such as banks and telcos, is strictly limited to providing technology support.

Since its inception in November 2022, the Hustler Fund has disbursed over Kshs.57.8 billion, of which Kshs.45.5 billion has already been repaid by borrowers.

Former Kakamega Governor Wyliff Oparanya addressing the media. Photo: Tuko Source: Facebook

The Ministry reassured Kenyans that all loan recovery efforts will be done in strict adherence to the law and data protection regulations, promising no rogue methods will be employed.

“The default recovery measures being considered are fully within the law and guided by data protection principles,” the Ministry reiterated, urging borrowers to continue repaying their loans on time to enhance their credit scores and access higher loan limits in the future.

The Ministry also took the opportunity to encourage borrowers, stating, “We remain dedicated to ensuring that the Fund grows and continues to provide financial inclusion at the bottom of the economic pyramid.”

With the recent clarification, the government hopes to put to rest any misconceptions and maintain the integrity of the Hustler Fund, while fostering transparency and accountability in its operations.