Notorious KRA is on the spotlight again after it arbitrarily started demanding payment of tax waivers issued in 2004 during President Kibaki. Here is the shocking turn of events.

In 2004, GoK reached out to the Kenya Breweries Limited and requested it to develop a low-cost clean alternative to illicit brews that were both a social and economic problem. By a letter dated 1st September 2004 KBL responded to the former Minister of Finance, Hon. Mwiraria, and advised that based on its analysis, they considered the Senator keg product to be the most appropriate solution to the illicit brew problem.

Since EABL had no infrastructure for production of low-cost beer, acceding to the request meant that it would have to create an entire value chain from onboarding farmers of barley to constructing a manufacturing plant for the low-cost at a cost of about Kes 1 billion. Despite the business risk, KBL agreed to undertake the program in support of GoK’s plan of fighting illicit brews.

Also see: Reactions to KRA’s outrageous tax demands

To achieve this, it was necessary that the cost structure for the beer be kept very low. This would in turn ensure that the price of the senator keg product remained low and therefore affordable to people who would otherwise be forced to consume illicit beer.

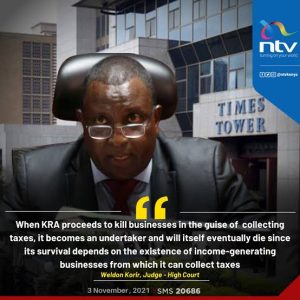

Justice Weldon Korir to KRA.

Courtesy: Nation

The govt acknowledged that one of the most significant components of the price of alcoholic beverages is the consumption tax known as excise duty. This is a tax charged to consumers and therefore paid by the consumers every time they purchase and consume alcoholic beverages. To achieve the goal of ensuring low prices for the senator keg, the Govt introduced incentives in the form of excise duty remission to local manufacturers who use local raw materials for the production of affordable and safe alcohol. A tax waiver as an incentive.

Remember, this tax incentive was to reduce the cost of the alcohol to make it more affordable to Kenyans and reduce the harmful effects of illicit alcohol in the country.

19 years later, on 25th April 2023, KRA wrote a demand letter to KBL demanding payment of Ksh. 8.2 Billion (8,204,929,625) after ostensibly revoking the previous tax waivers that were passed within the law.

The other day KRA did the same to NCBA Bank and today, it is extending its reckless, selective and ill-informed move to EABL. Such miscalculations that will only result in destroyed businesses and have sent shockwaves to investors who are left wondering:

• Does KRA respect legally binding deals and agreements such as tax waivers?

• Will the present tax waivers being given to encourage investors set base in Kenya still be valid after 5 or 10 years? Or they will wake up to demand latters with penalties out of nowhere?

• Is Kenya a safe place to invest in? Can foreign investors trust the government?

Investors are fleeing the country and we will only have KRA to blame.