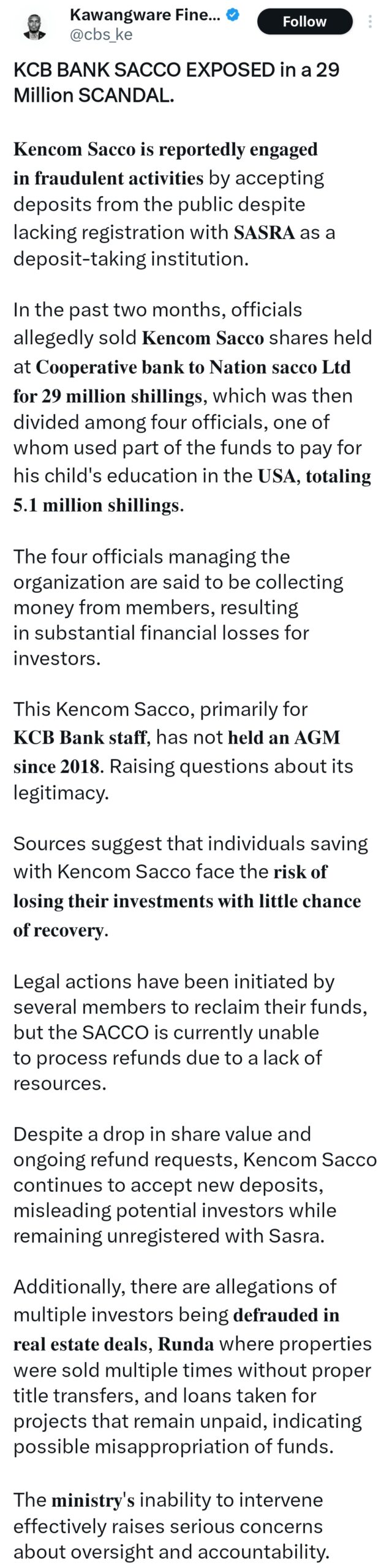

It’s a scandal that has everyone talking: Kencom Sacco, closely tied to KCB Bank staff, is making headlines for all the wrong reasons. At the centre of it is a shocking KSh 29 million fraud that’s left members fuming and fingers pointing at KCB Bank itself.

According to Kawangware Finest, one of influential X bigwigs, Kencom Sacco recently sold shares held at Cooperative Bank to Nation Sacco Ltd for KSh 29 million.

But instead of those funds benefitting the hardworking members, it’s alleged that four Sacco officials pocketed the money. One of them even used KSh 5.1 million to pay for their child’s education in the USA!

But that’s not all. Kencom Sacco isn’t even registered with SASRA as a deposit-taking institution. That’s right—it’s been taking deposits from the public without proper authorisation. And yet, despite the obvious red flags, KCB Bank hasn’t stepped in to ensure things are above board.

KCB bank. Photo: The Star Source: Facebook

Members are now left wondering how this could happen under the watch of a Sacco tied to one of Kenya’s biggest banks.

To make matters worse, Kencom hasn’t held an AGM since 2018, and there are allegations of dodgy real estate deals where properties were sold multiple times without proper title transfers. Loans meant for projects? Unpaid.

So where does this leave KCB Bank? Critics are saying the bank should have had better oversight of a Sacco so closely associated with its staff. With legal battles heating up and members demanding answers, KCB’s reputation is now under the microscope.

This scandal has raised one big question: if Kencom Sacco is failing its members, what role should KCB Bank play in fixing the mess? Only time will tell, but for now, the pressure is on.